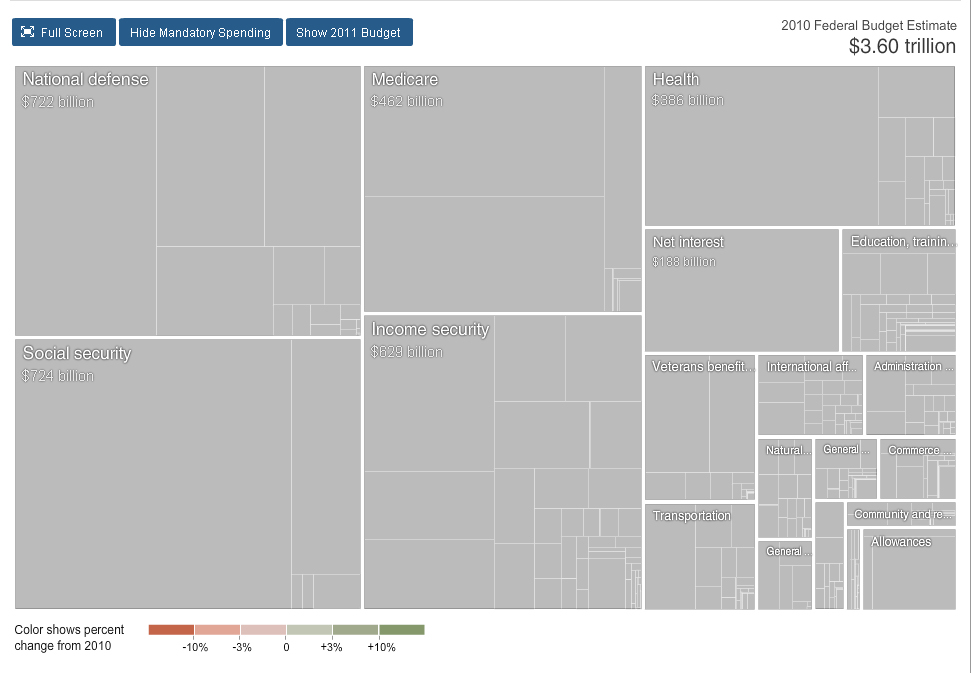

In the post Show Me Your Budget, I addressed the U.S. federal budget via an illustration that used proportionally sized boxes to reflect spending priorities. What I didn’t cover was how we pay for those boxes, both the overall box of the entire budget, as well as its constituent departments and programs.

When you get right down to it, as taxpayers, we purchase a set of goods and services from the U.S. government. In exchange for our taxes, fees and surcharges we get a campsite in a national park, an interstate highway system, a (supposedly) regulated financial system, an Army, Navy, Air Force and Coast Guard, a Border Patrol, CIA, NSA, FBI, DEA, TSA and countless other three letter acronym agencies, federal standards for everything from allowable amounts of insect parts in hot dogs to airplane tire performance and too many other goods and services to include in this post. We take most of these goods and services for granted, as we do how those goods and services are paid for.

Every one of those goods and services comes from one of the boxes in the illustration. What we don’t think about is how we buy those boxes.

(click image for larger size)

In the case of the United States government, we buy our boxes in two ways:

1. Government revenue via interest income, taxes, fees, duties, and other payments

2. Loans from willing lenders to cover the difference when what the government spends (outflows) exceeds what the government takes in (inflows)

When an individual or a family spends more than they earn, they typically cover the difference via credit cards or, more rarely, through loans. Those credit card debts are secured by the card holder’s promise to pay back the debt, basically an IOU. Formal loans usually require collateral, a tangible asset that will be seized if the loan is not repaid, such as a house or a car. In contrast, the U.S. government does not put up any collateral when people loan it money, it just issues an IOU in the form of a bond or Treasury note. Both of those instruments promise that we, the American taxpayers, will repay that loan along with interest. So far, the collective promise of repayment by the American taxpayers has been viewed as a valid, investment class promise by everyone in the world who has funded our profligate ways by buying U.S. government IOUs. As long as they keep believing we’ll eventually repay them and keep loaning us money, we keep spending more than we earn.

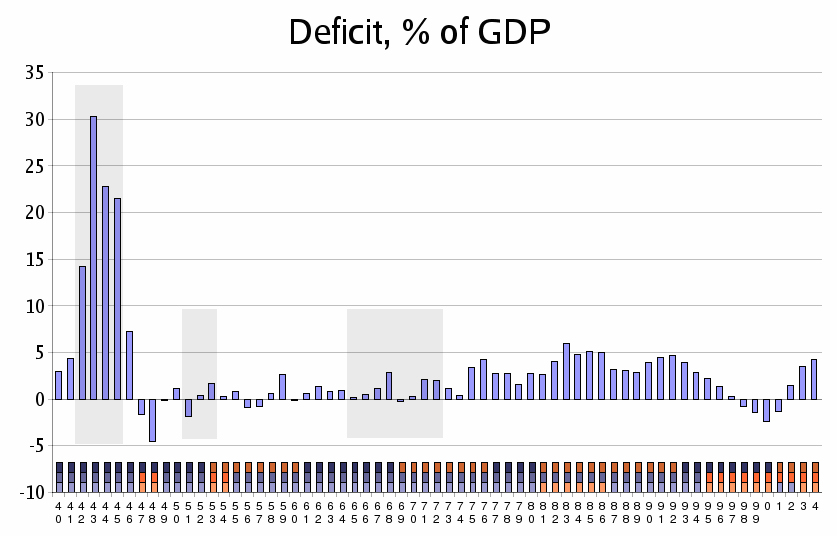

The United States government has spent more money that it earned for 47 out of the last 55 years. In each of those 47 years, the U.S. has needed to borrow the difference between its outflows, what we as a nation spent, and its inflows, what the nation took in. That difference, that delta, is commonly referred to as the deficit.

The U.S. government 2010 fiscal year deficit is projected at $1.56 trillion, or 10.6 percent of gross domestic product (GDP – the total value of goods and services produced in our economy in a year). That means in the 2010 budget cycle we are spending $1.56 trillion more dollars that we are taking in via interest income, taxes, fees, duties, and other payments. The United States has not seen deficits above 10 percent of GDP since World War II.

(click image for larger size)

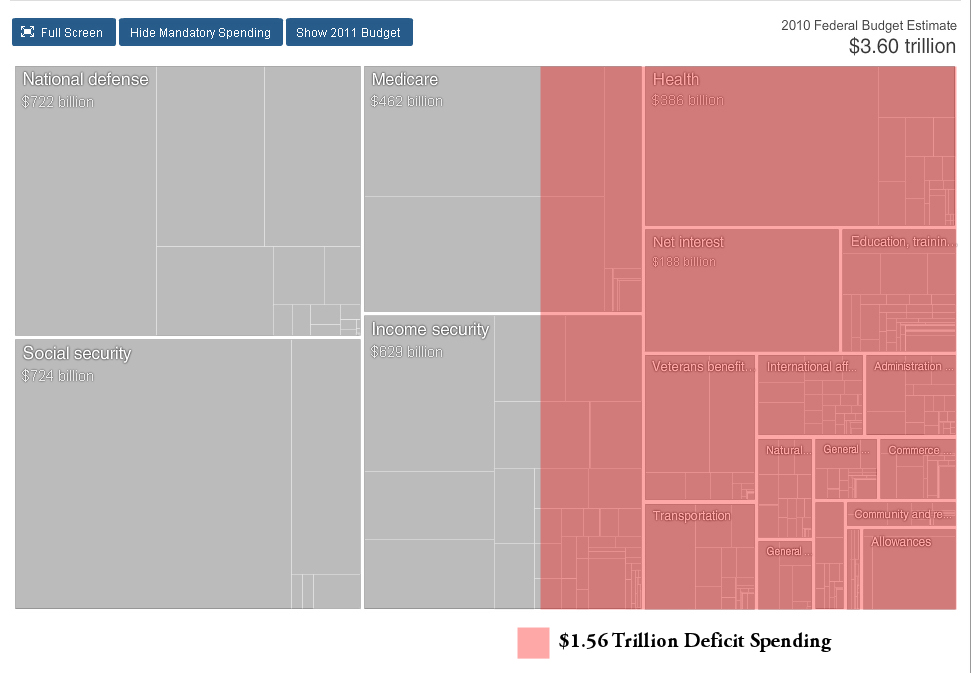

When the projected $1.56 trillion dollar deficit (the red area) is overlaid on the 2010 budget, you get a visual idea of how much we can actually afford and how much we need to borrow to fund our collective lifestyles.

(click image for larger size)

When the projected $1.56 trillion dollar deficit is applied to the 2010 budget, you can see that the portion of government spending that we can actually afford leaves such basics as health, education, training, veterans benefits, international relations, natural resources, transportation, energy, commerce and administration unfunded, to say nothing of the interest payments on the $12.394 trillion national debt we already owe.

Who is willing to loan this country, which is obviously incapable of living within its means, $1.56 trillion on top of the existing $12.394 trillion we already owe? Basically, the same people and methods used for the last 55 years.

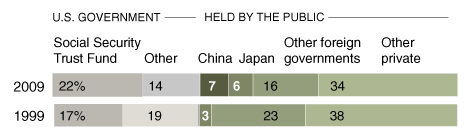

U.S. debt is held by American individuals and companies, U.S. government controlled entities, foreign nations and foreign individuals and corporations.

You will note the graphic reflects that in 2009 22 percent of U.S. debt was owned by the Social Security Trust Fund. Because there are so many people in the Baby Boomer generation, while they were working and contributing to the social security system that system ran huge surpluses. Those surpluses were supposed to be held in a trust fund to pay the bills when those same massive numbers of baby boomers retired. Unfortunately, the social security trust fund was accessible by congress, whose members either spent it outright on various boondoggles and earmarks, or used it to cover part of the deficit by purchasing the government’s IOUs. In addition to social security trust funds, surplus funds from other retirement trust funds controlled by the government, such as the retirement trust for government employees, were used to purchase government debt IOUs, which total 14 percent of U.S. debt holdings.

All told, 36 percent of U.S. IOUs were purchased by retirement trust funds that will now be short that money when it is needed to pay their retirees. In order to pay the money back to the trust funds, along with the interest owed, the American taxpayers will need to pony up the money. In essence, the taxpayers put the money away for retirement via social security and withholding taxes, only to have that money misappropriated by congress to cover the deficits of the U.S. government. Now, when the money is needed, the very same taxpayers, or more precisely, the taxpayers’ tax paying children and grandchildren, will need to pay that same money again to cover the IOUs, along with interest. The retirement money was originally paid by the baby boomer retirees, it was stolen by congress to cover the deficit and turned into IOUs, now the retirees’ children and grandchildren will need to pay off the IOUs to pay for their parents’ and grandparents’ retirement. Consequently, it will cost the American people more than double to pay for the retirement of everyone affected in the social security and government pension programs. This logic only makes sense if you are a Unites States Representative, Senator or President.

Among the foreign holders of U.S. debt, China and Japan lead with a total of $1.524 trillion dollars, or 42.2% of the $3.614 trillion total outstanding U.S. government debt held by foreigners. Other top foreign holders of U.S. debt include the United Kingdom (3rd with $302.5 billion, or 8.4%); the oil exporting countries (4th with $186.8 billion, or 5.2%); and the Caribbean Banking Centers (5th with $184.7 billion, or 5.1%).

In addition to the foreign governments, an unknown amount of U.S. debt categorized as owned by “individuals” is owned by foreign nationals, ranging from despots diversifying their portfolios from their Swiss bank accounts to investment funds to shopkeepers.

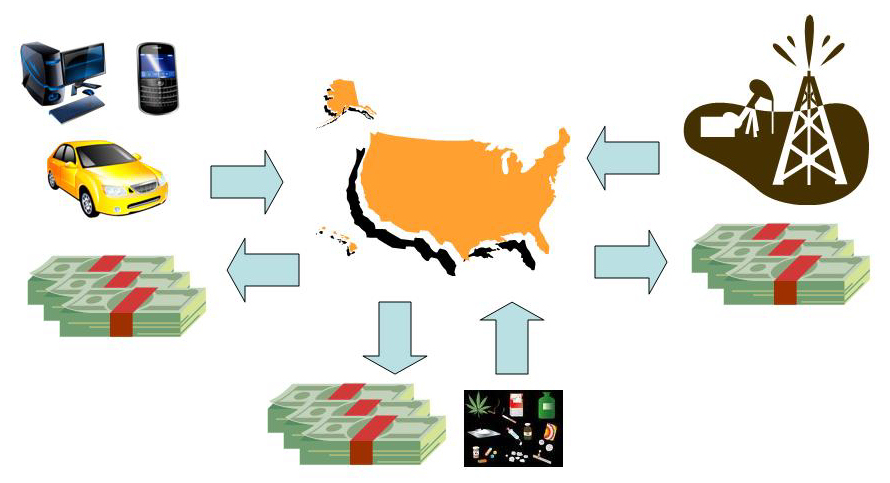

At the national level, the system is a basically a barter exchange. The U.S. sends billions of dollars per day overseas in exchange for oil, illegal drugs and manufactured goods. This leads to a huge difference between the value of what we sell other nations compared to what we buy from them. This difference in trade, this delta, is commonly referred to as the trade deficit. In 2009 the U.S. trade deficit was $380.66 billion, of which $226.83 billion was with China (both totals were the lowest in years due to the massive economic recession).

(click image for larger size)

For the last 55 years, those trade deficit nations have seen fit to turn many of those dollars around and used them to purchase U.S. government debt.

(click image for larger size)

This money laundering system has served as a bottomless ATM for the U.S. We’ve spent most of the last 55 years living beyond our means and borrowing against our assets, in this case, an asset that is nothing more than a promise that the taxpayers would repay the IOUs. In that sense, it’s very similar to how Americans lived during the recent real estate bubble, when many U.S. homeowners treated their homes like limitless ATMs, continually leveraging that asset via refinancing their mortgages to fund their spendthrift lifestyles. As we all know, that idea worked great until the real estate bubble burst.

Will the U.S. national debt IOU bubble ever burst in a similar fashion?

For it to burst, the nations, organizations and individuals selling us oil, illegal drugs and manufactured goods who have been willing to buy our IOUs would need to lose faith in our ability, or stated more accurately, our children’s and grandchildren’s ability to repay those IOUs. If the people covering our deficits ever lost faith, and foreign nations, organizations and individuals stopped buying our U.S. government IOUs, interest rates would soar (to make the IOUs more attractive by providing high returns) and the dollar would collapse, along with the U.S. economy.

If other nations, organizations and individuals stopped buying the U.S. government’s IOUs, we would have two choices. We could either double taxes, fees, duties and other sources of income to make up the $1.56 trillion dollar deficit or we could shrink government spending until all the boxes of government spending fit into the area we can afford to fund ourselves.

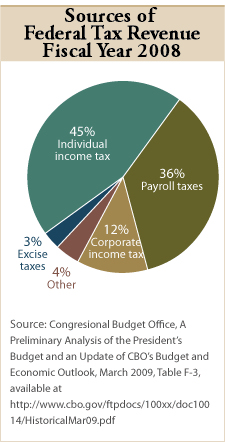

If you think doubling taxes, or, in the American way, taxing the rich to pay for the deficit, is the best approach, consider the following. If you doubled taxes only on the rich, they would be taxed at 70 percent of their income. Since only taxing the rich would probably not provide enough income to cover the $1.56 trillion dollar deficit, you would probably need to raise that rate higher, perhaps to 80 percent or more. In states that add state income tax, such as California, the rich would be paying more than 90 percent of their income in taxes. Historically, such systems have not proven effective for the overall economy. For example, top marginal rates in the United Kingdom exceeded 80 percent in the 1970s and their economy nearly ground to a halt. And besides, individual income taxes make up only 45 percent of U.S. government income, so it may not even be possible to make up the deficit regardless of how much you tax the rich.

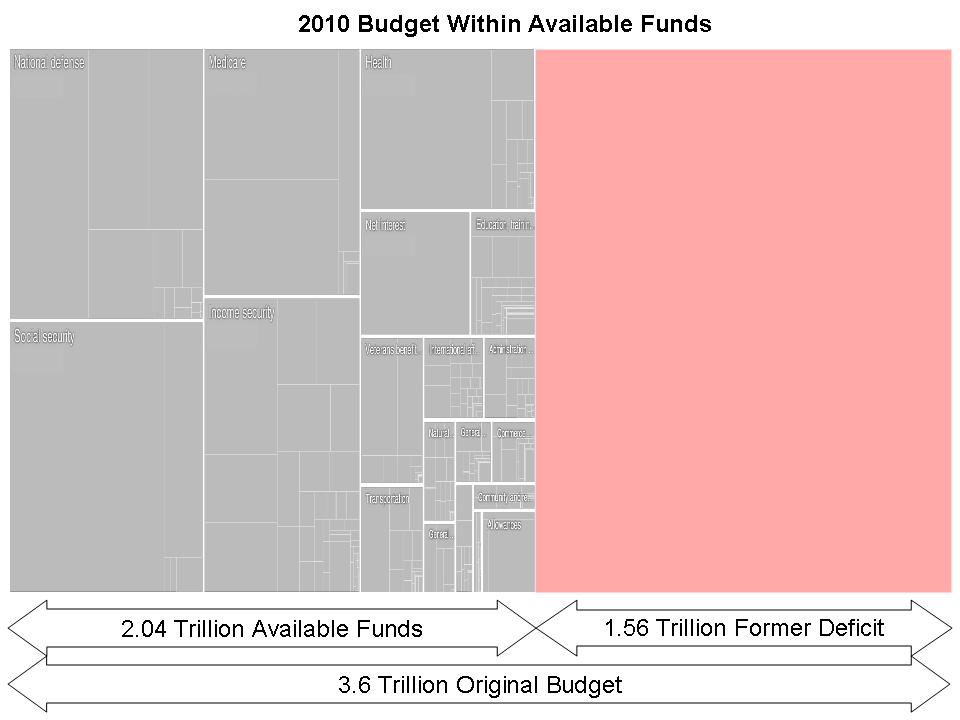

Since doubling taxes, even if only on the rich, probably won’t work, we would need to dramatically reduce government spending to fit within a box we could actually afford.

(click image for larger size)

As you can see in the illustration, if you shrink the federal government down to where it can fit within a box the American taxpayer can actually afford to buy, some of the departments and programs start to get very small. We could end up with one guy with a cell phone and a laptop in charge of infectious diseases or an entire Navy rusting at the docks because we couldn’t afford to fuel the ships or pay the sailors to use them. In order to make this scenario work, as a nation, we would need to make very tough choices. That means our elected representatives would need to make very hard choices with what’s best for the nation being the only criteria. OK, so that’s obviously not going to happen.

Of the two options, doubling taxes, fees, duties and other sources of revenue would cripple the economy while cutting government spending enough to shrink all the boxes to fit into the area we can afford to fund would require decision making and leadership our current political ruling class is incapable of executing. If we could somehow implement either option or a blend of the two, it would be the end of living beyond our means and the beginning of an entirely new form of the United States of America.

But we don’t have to worry about that as long as other nations, organizations and individuals continue to be willing to buy our U.S. government IOUs in exchange for a promise that the American taxpayers, their children and grandchildren will repay the debt.

And that gravy train will never stop, right?

*******

News Item: China liquidated $34.2 billion of US Treasury securities in December 2009, initiating their previously communicated plan to “diversify” their more than one trillion dollars worth of primarily U.S. dollar denominated hard currency reserves.

*******

Notes:

- United Kingdom includes Channel Islands and Isle of Man, well known offshore tax havens used by people and organizations seeking to hide and disguise assets.

- The oil exporting countries include Ecuador, Venezuela, Indonesia, Bahrain, Iran, Iraq, Kuwait, Oman, Qatar, Saudi Arabia, the United Arab Emirates, Algeria, Gabon, Libya, and Nigeria.

- The Caribbean Banking Centers are nations often used as offshore money laundering operations for the drug cartels and other criminals and tax evaders: Bahamas, Bermuda, Cayman Islands, Netherlands Antilles and Panama and the British Virgin Islands.

- Foreign debt based on estimated foreign holdings of U.S. Treasury marketable and non-marketable bills, bonds, and notes reported under the Treasury International Capital (TIC) reporting system are based on annual Surveys of Foreign Holdings of U.S. Securities and on monthly data.

Sources:

- United States Treasury

- Internal Revenue Service

- Tax Policy Center of the Urban Institute and Brookings Institution

- MSNBC

- Daily Mail

- New York Times

- US Debt Clock.org

- Financial Times

- Reuters

- Wall Street Journal

- Traxel.com

Pingback: Autopsis » Blog Archive » Ever Bigger Boxes